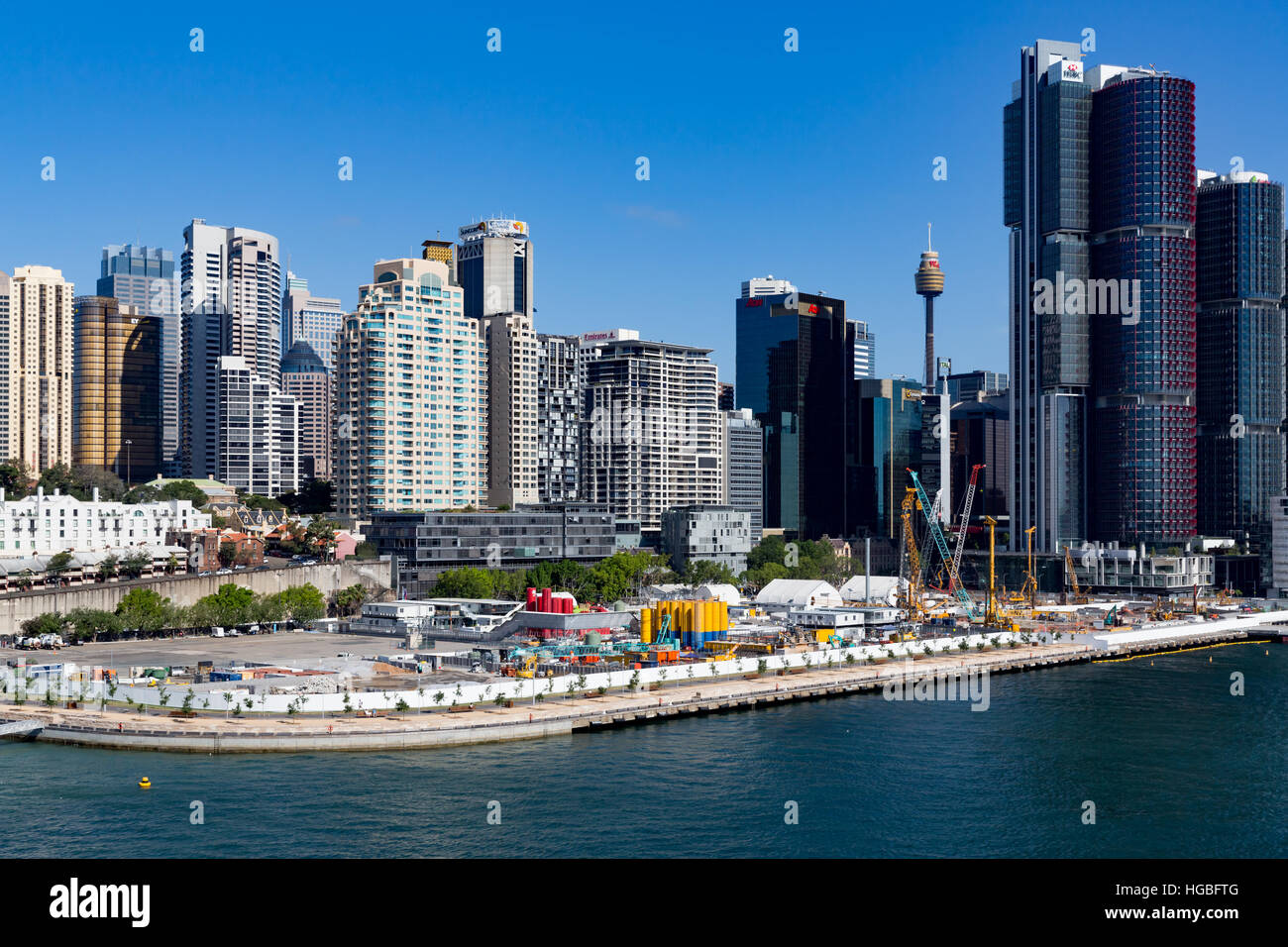

James Packer Crown Casino

James Packer has admitted he engaged in 'shameful' and 'disgraceful' conduct over a series of threatening emails he sent to a high-profile businessman in 2015, but blamed his bipolar disorder for. The billionaire faced an inquiry into Crown Casino today reportedly appearing via video link from his yacht. The identity of the businessman who was threatened by Mr Packer was not revealed but. James Packer of Crown Resorts leaves after attending the Crown Resorts annual general meeting on October 26, 2017 in Melbourne On the second day of the inquiry on Wednesday, Mr Packer blamed Crown. James Packer risks losing his licence to operate the Crown Sydney casino at Barangaroo on the harbourfront. The resort is due to open in December but an inquiry into Crown’s suitability to operate a casino is ongoing. Packer is pictured inspecting the Crown Sydney site in January. James Packer appearing at a NSW inquiry into Crown's suitability for a casino license. Its shares have recovered since a hammering revealed in 2019-20 accounts for Packer flagship Consolidated.

- »News

- »James Packer’s Legal Team Distance him from Crown Failures

Packer’s Legal Team Looks to Distance him from Crown Failings

Crown Resorts’ numerous failings, as outlined by a New South Wales government inquiry, are not all James Packer’s fault.

That’s the assertion made by lawyers for Consolidated Press Holdings, the private investment company of James Packer.

James Packer Crown Casino

The Australian Financial Review reports that CPH’s legal team, headed by Noel Hutley, SC, told inquiry Commissioner Patricia Bergin that she should reject the submission its clients had a “deleterious impact” on the company’s good governance.

“We respond to counsel assisting’s an approach whereby they seek to attribute at least some of the blame of the failings of Crown Resorts to Mr Packer and CPH,” Mr Hutley said.

“This is an unwarranted and unfair characterisation of Mr Packer’s role, which is simply not supported by the evidence before the inquiry.”

The inquiry has heard submissions that the gaming giant was “recklessly indifferent” to money laundering risks and never had robust enough processes to review the integrity of junket partners.

They have put Mr Packer at the centre of these concerns, particularly the push to bring offshore high-rollers to Crown’s Australian casinos through junkets or other means, which also led to the arrest of Crown staff in China in 2016.

Mr Packer said many of the failures outlined before the probe were a total shock to him when giving evidence last month, and Mr Hutley claimed this should be believed as the billionaire was honest and candid in the dock.

The government’s probe will release its report by February 2021 whether Crown and its close associates are suitable to hold a gaming licence for the near-complete Barangaroo casino in Sydney.

60 Minutes Australia James Packer Crown Casino

It has already raised the prospect of investment or voting right caps on Mr Packer’s 34 per cent shareholding in Crown.

Counsel assisting have said the casino giant is unsuitable for the Barangaroo licence due to several cultural, governance and risk management failures over the last decade.

These closing submissions come as Crown faces increasing pressure to delay the planned opening of the casino in December and ILGA plans an urgent meeting next week to resolve the issue.

Mr Hutley’s argument appeared to run into an early obstacle when Commissioner Bergin interrupted.

“Mr Packer did say that he accepted some responsibility for the corporate governance failings of Crown,” the Commissioner pointed out.

Mr Hutley accepted this was the case for when Mr Packer was executive chairman of the company until March 2018, yet said he was dealing with the billionaire’s influence from November that year onwards.

By such time, Mr Packer had also left the operational side of CPH and was still receiving confidential Crown information through a controlling shareholder protocol kept secret from other investors.

Via the protocol, Mr Packer sent demanding emails to various Crown executives seeking information and updates on certain matters.

Still, Mr Hutley said those presented before Commissioner Bergin were too small a sample to conclude the billionaire had a profound sway over the company.

Crown has now terminated the controlling shareholder protocol.

Mr Hutley said the period after November 2018, was the only one relevant to Mr Packer’s current suitability to be a close associate of Crown’s licence for its Barangaroo casino in Sydney.

Inquiry Deems Crown not Suitable to Hold Sydney Casino Licence

Crown Resorts has been deemed not suitable to hold the licence for its soon-to-be-opened casino in inner Sydney.

The ABC reported in early November that the Independent Liquor and Gaming Authority has been examining the conduct of Crown in its current casinos in Melbourne and Perth, including its international VIP gaming operations.

In his closing submissions, counsel assisting Adam Bell SC told the inquiry he believed Crown was not suitable to hold the licence for the new Barangaroo premises.

“In summary, we submit that the evidence presented to this inquiry demonstrates that the licensee is not a suitable person to continue to give effect to the licence and that Crown Resorts is not a suitable person to be a close associate of the licensee,” he said.

The inquiry has raised serious allegations that the company ignored warning signs of money laundering within its casinos, partnered with junket operators despite their links to organised crime and ignored the safety of their staff in China, who were technically working illegally.

Mr Bell highlighted the arrest of the employees in China four years ago as a significant factor in the company’s failures.

Nineteen employees were arrested and charged for promoting gambling to source VIPs for its high-roller business, 16 who was eventually imprisoned in a Chinese prison.

Young men have almost doubled the amount they spend on gambling each month....

Young men have almost doubled the amount they spend on gambling each month.

Crown’s biggest shareholder James Packer was allegedly the driving force behind the high-roller push. Picture: Aaron Francis/The AustralianSource:News Corp Australia

The inquiry into Crown Resorts’ alleged facilitation of money laundering has been told James Packer’s involvement with Asian junkets was to build relationships but was “rare and superficial”.

Wrapping up his closing submissions to the NSW Independent Liquor and Gaming Authority probe on Friday, barrister Noel Hutley, acting for Mr Packer and his private investment company Consolidated Press Holdings, said the billionaire’s dealings with junket operators were only to build rapport to help Crown increase its market share in the high roller gaming sector.

It has been suggested Crown’s junket partners had links to organised crime in Hong Kong and Macau and laundered huge amounts of money at its Melbourne and Perth casinos.

It has also been suggested by Commissioner Patricia Bergin that Mr Packer – despite resigning from the board of Crown in 2018 – was the driving force behind the company’s push to lure more VIP gamblers to the venues.

“The contention that Mr Packer and CPH had some overbearing influence over the affairs of Crown Resorts is simply not supported by the evidence,” Mr Hutley said.

He asserted it could not be said that any influence Mr Packer had on the company rendered Crown unsuitable to hold the licence for its new $2 billion-plus development at Sydney’s Barangaroo harbourside, which is slated to open next month but could be delayed, with Ms Bergin to hand down her decision on February 1.

The inquiry is determining whether Crown is fit to hold the gaming licence for its new Barangaroo casino.Source:Supplied

“In addition there is no evidence that Mr Packer had any adverse impact on Crown Resorts or the public interest, and in fact … Crown and its shareholders had benefited from the involvement of Mr Packer and CPH over many years,” Mr Hutley said.

Counsel assisting Adam Bell has previously urged the commissioner to recommend to ILGA that it reconsiders its approval of Mr Packer as a “close associate of the licensee”, having regard to threatening emails he sent to an unnamed businessman in 2015 around privatising Crown.

When Mr Packer testified at the inquiry, he labelled the conduct “shameful” but said his behaviour was a direct result of his battle with bipolar disorder.

Ms Bergin questioned why Mr Packer’s mental health issues were not disclosed to the board and senior management after he stepped down as a director.

Mr Hutley said: “He (Mr Packer) left quite appropriately at that stage when he realised he was not up to the job”.

The reclusive billionaire remains Crown’s biggest investor, and the inquiry has heard he was given special treatment over others through a “controlling shareholder agreement” under which he and CPH were handed sensitive and confidential information.